Get the credit and financing you've been looking for!

Yes, you can do this—and it’s 100% legal, 100% verified, and built on real expertise. With nearly 90% of the information online outdated or flat-out wrong, most business owners waste time and money chasing junk advice. The W.O.C Business Credit Program is different. It’s the most comprehensive, researched, and proven system available anywhere. If you have a Corporation or LLC, you already qualify. Now it’s affordable to access the program with financing, get immediate approvals, and see results in days. We’ve been through the trenches, seen every mistake, and know exactly how to get you approved for the business credit cards and funding your company needs.

The Mystery of Business Credit — Solved

Most business owners are lost when it comes to building credit. We remove the confusion and give you the answers that matter:

Which business credit scores matter most?

What do lenders really look at before approving you?

Where can you find companies that actually grant credit?

How do you get approved the right way?

Which companies report to the bureaus (and which don’t)?

Which credit cards don’t require a personal guarantee?

👉 With W.O.C, the mystery disappears—you’ll know exactly what to do to build strong business credit and become bankable.

Advantages of a Business Credit Profile

Your business credit profile isn’t just a scorecard—it’s leverage, protection, and opportunity.

Limit personal guarantees while building credit in your business’s name

Access more cash and improve purchasing convenience

Protect personal assets by separating them from the business

Skip personal credit checks when applying for financing

Purchase vehicles with no personal guarantee required

Finance equipment, computers, and more through business credit

Prepare your business for future lending needs with confidence

👉 With a business credit profile, your company stands on its own—stronger, safer, and ready to grow.

Separating You From Your Business

Incorporating or forming an LLC doesn’t just give you structure—it gives you protection and growth potential.

Separate yourself from liability and safeguard personal assets

Reduce taxes with more deductions and credits

Strengthen your corporate image and credibility

Raise capital and build credit faster as an incorporated entity

Lower your audit risk as a small corporation

Transfer assets easily with stock ownership

👉 Incorporation isn’t just paperwork—it’s the foundation of financial freedom and business growth.

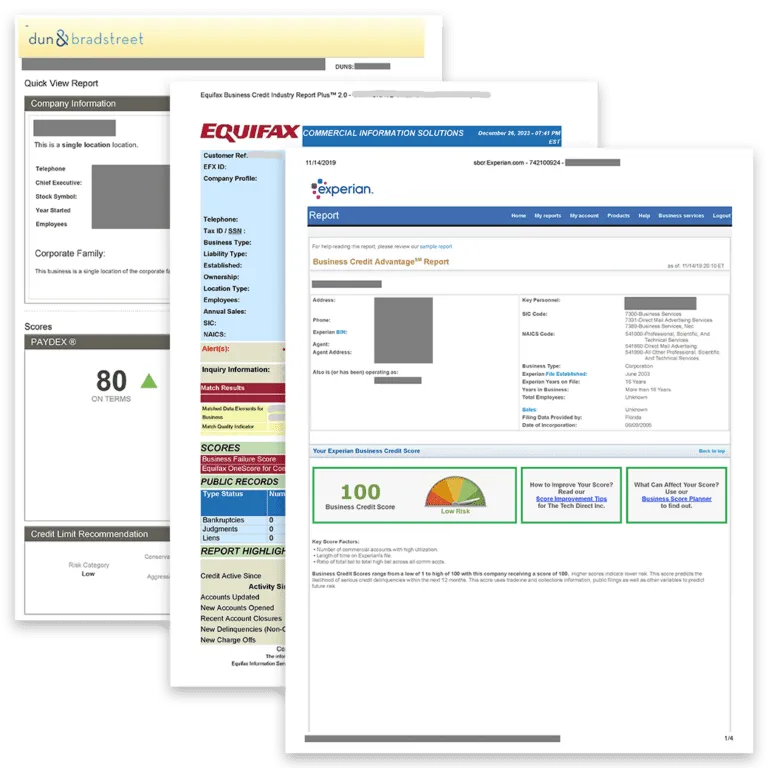

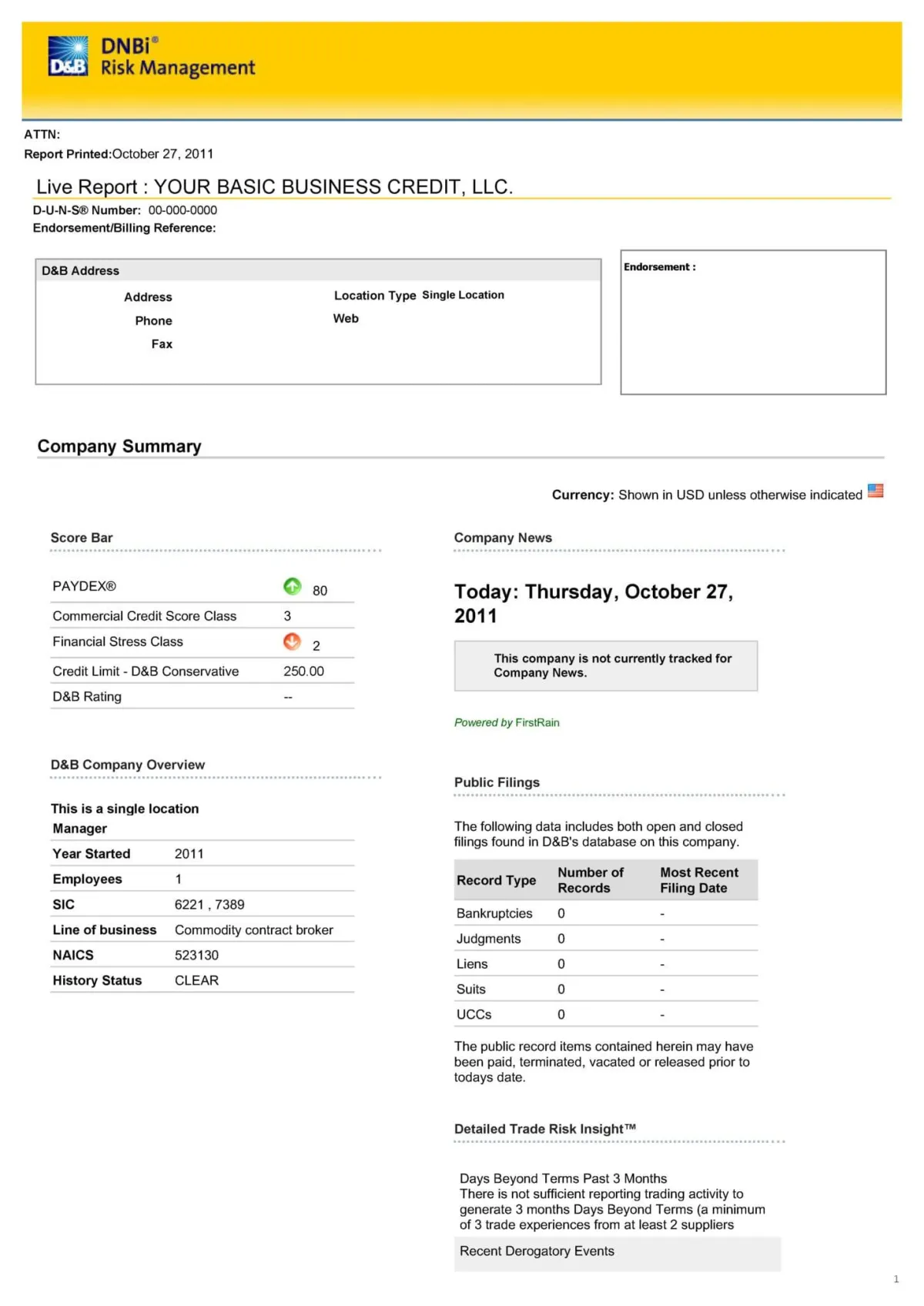

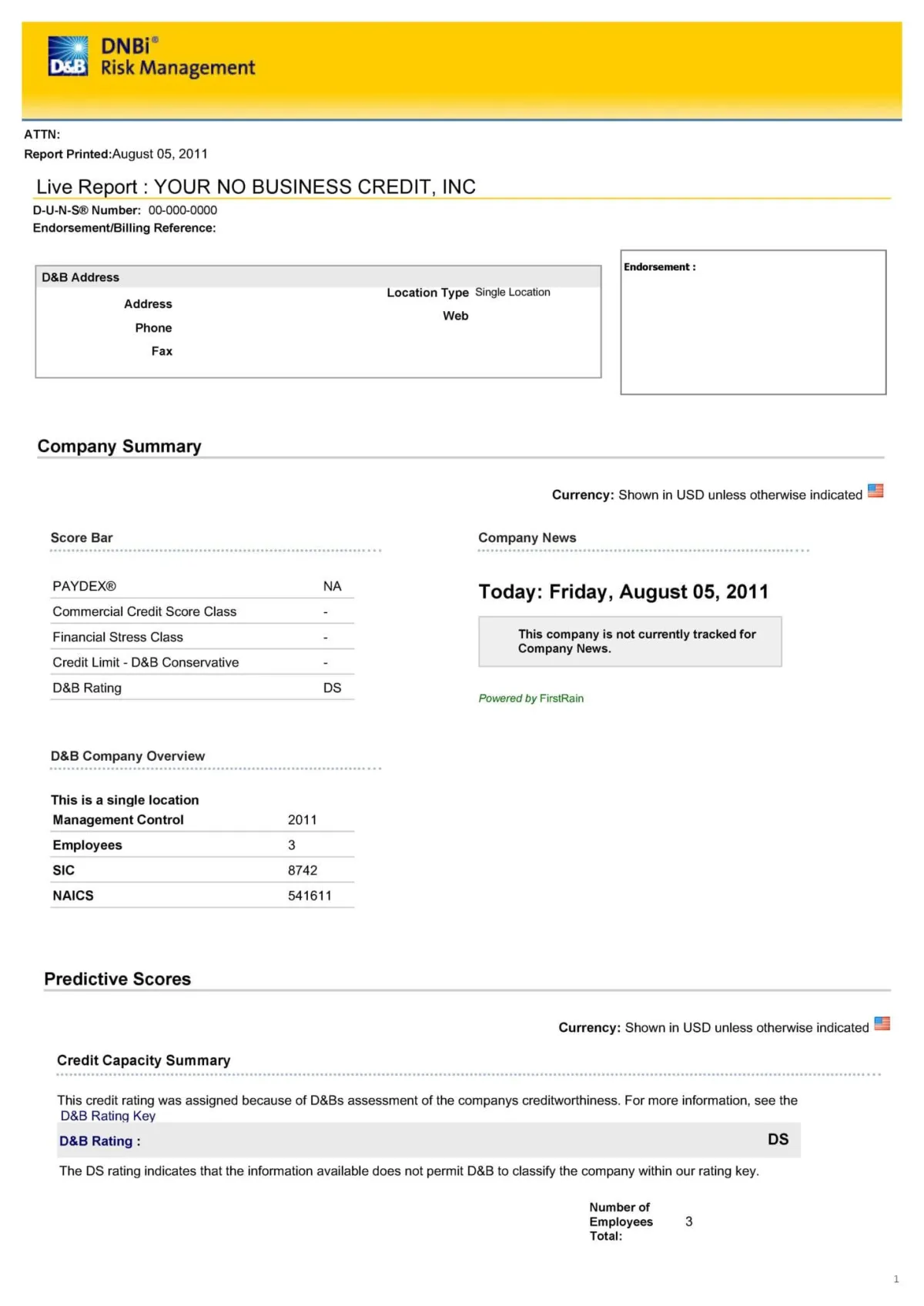

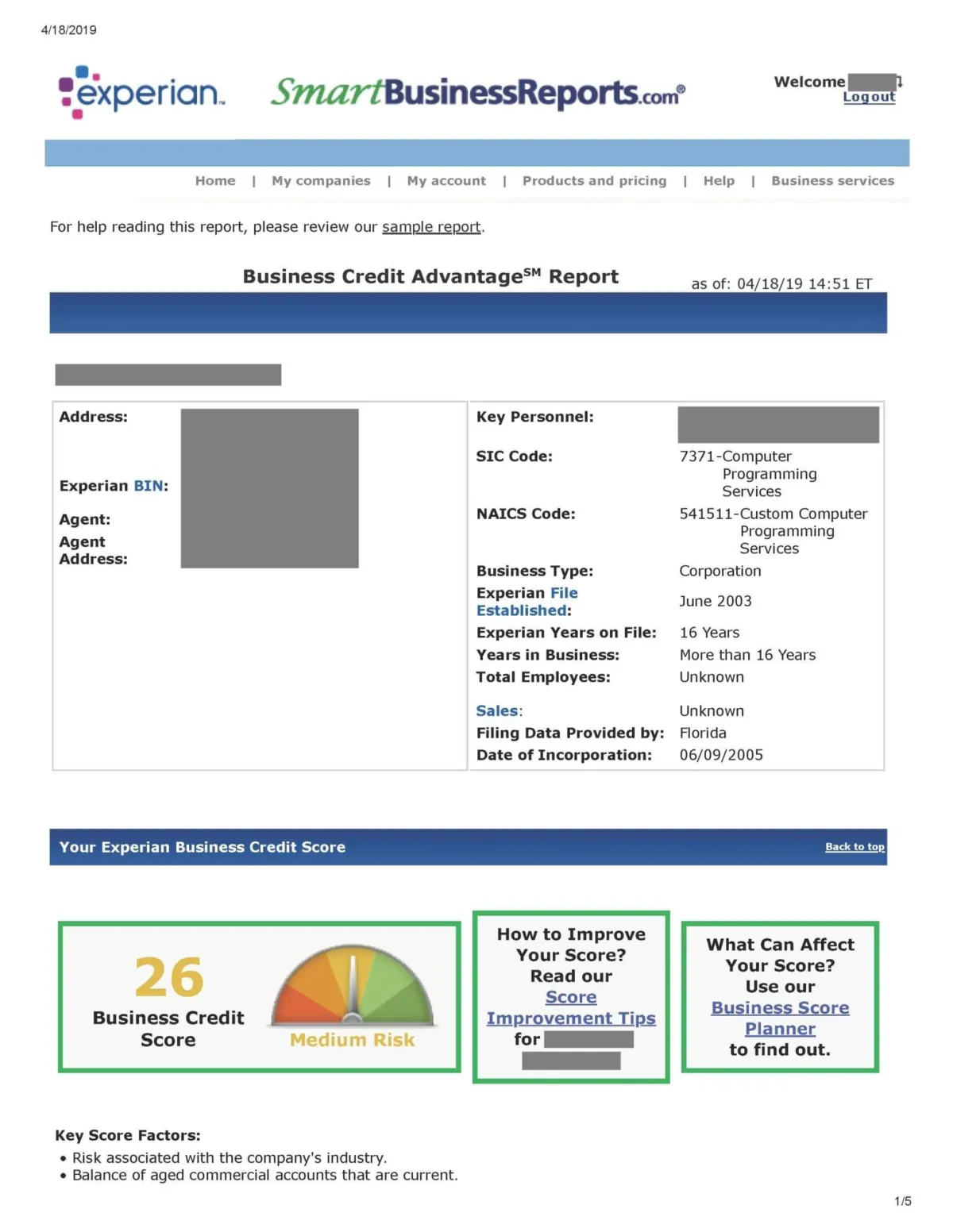

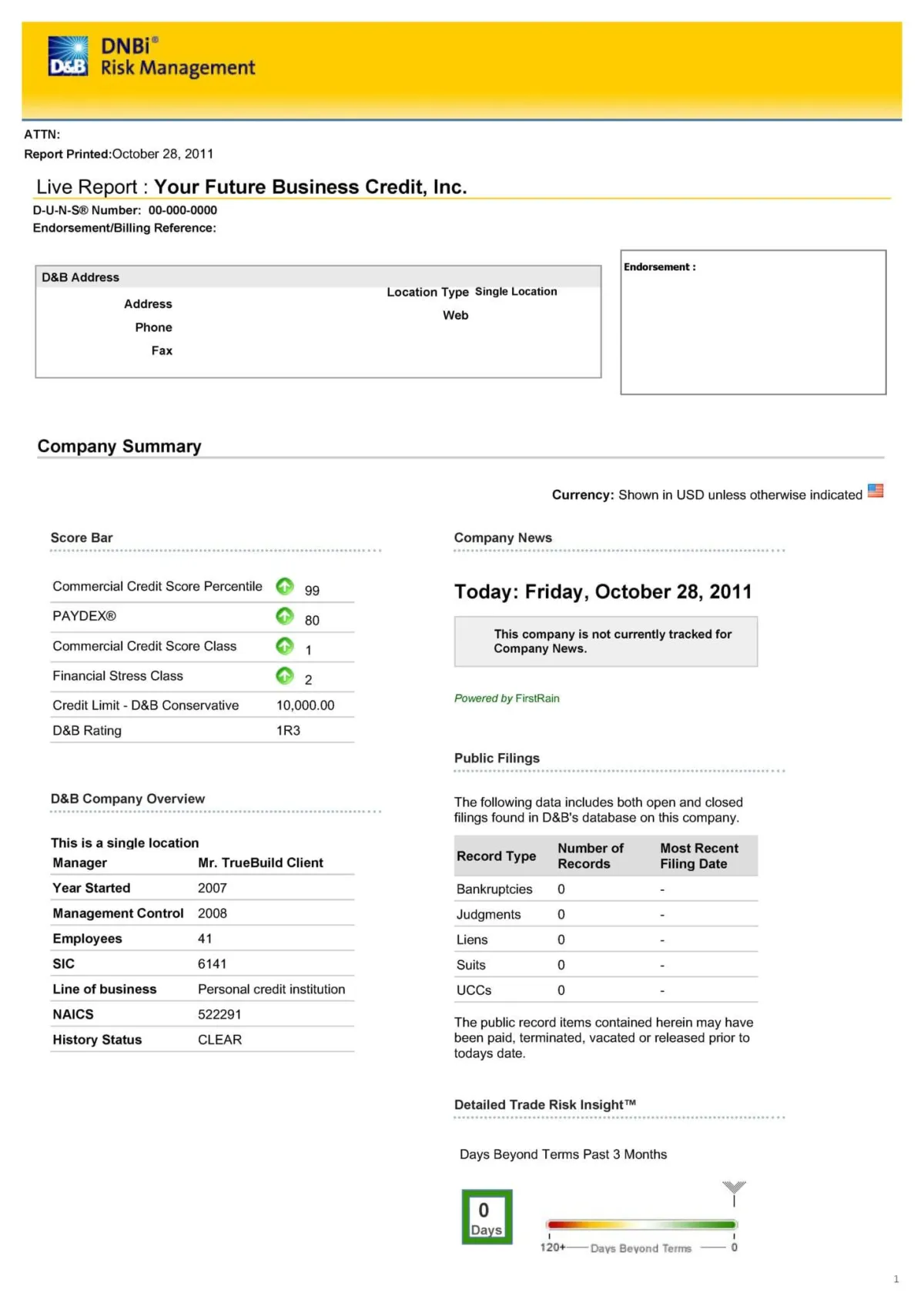

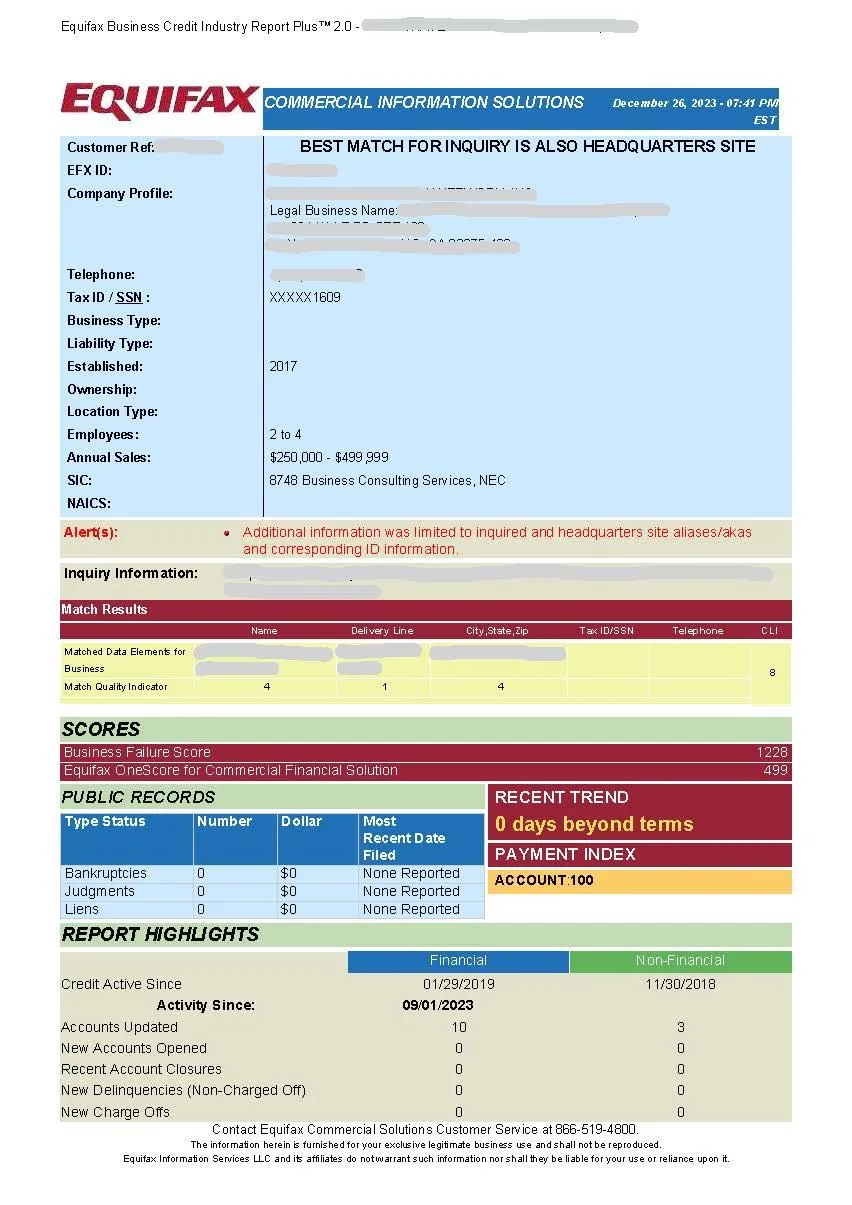

Business Credit Agencies

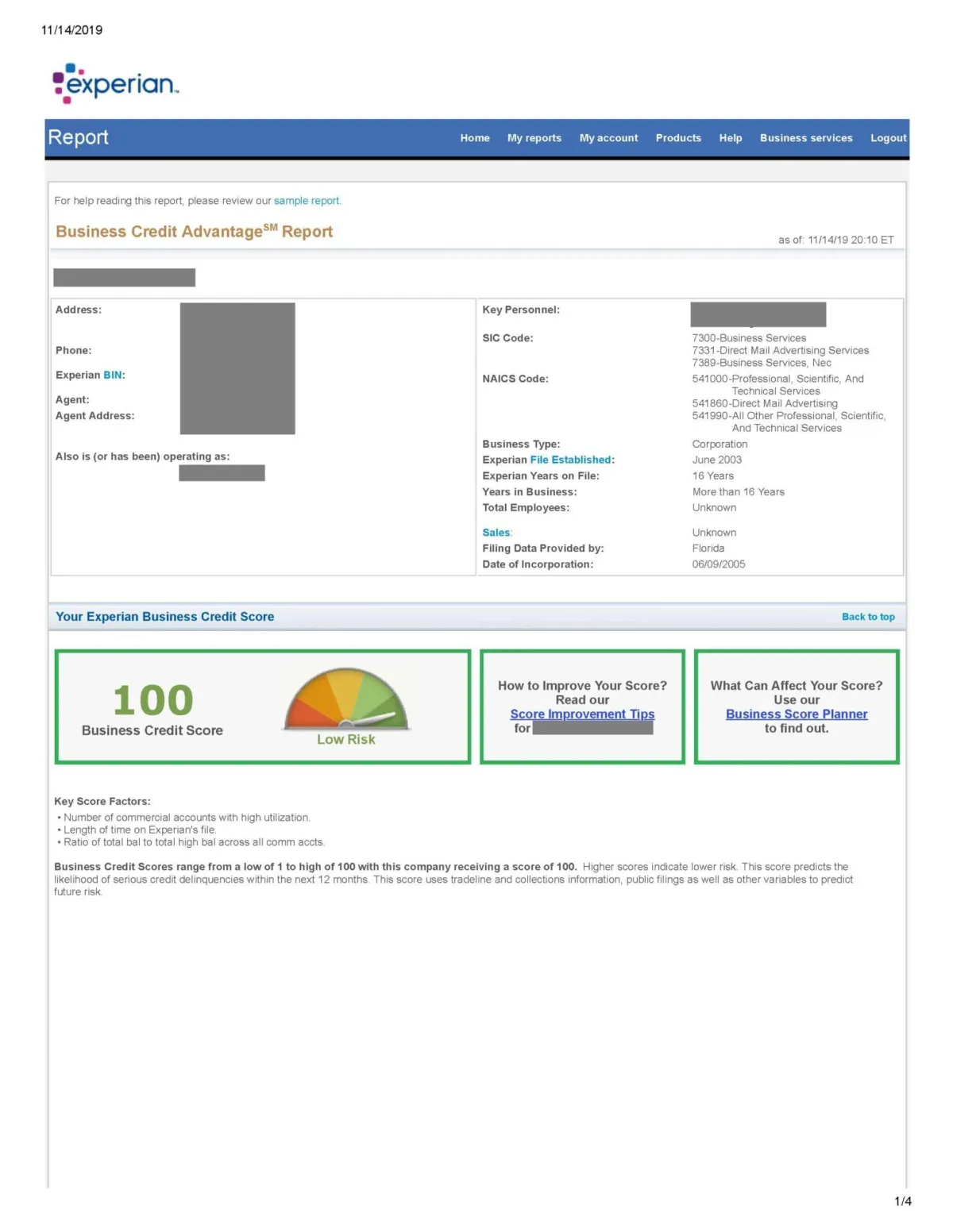

There are four main business credit reporting agencies in the United States that lenders and financial institutions rely on for information to grant credit. The four credit agencies are D&B®, Experian Business, Equifax Commercial and FICO SBSS.

Over 32 million U.S. businesses are registered with D&B ®

The credit profile created by D&B ® uses information provided by vendors and self reporting by the business owner

PAYDEX score based on reported and verified payment experiences of the business

DUNS Rating based on the financial and firmographic statements of the business

Over 25 million U.S. businesses are registered with Experian

The credit profile created by Experian uses information provided by vendors and the SBFE

Intelliscore based on reported payment experiences and firmographic information of the business

Financial Stability Risk Rating based on the overall financial health of a business

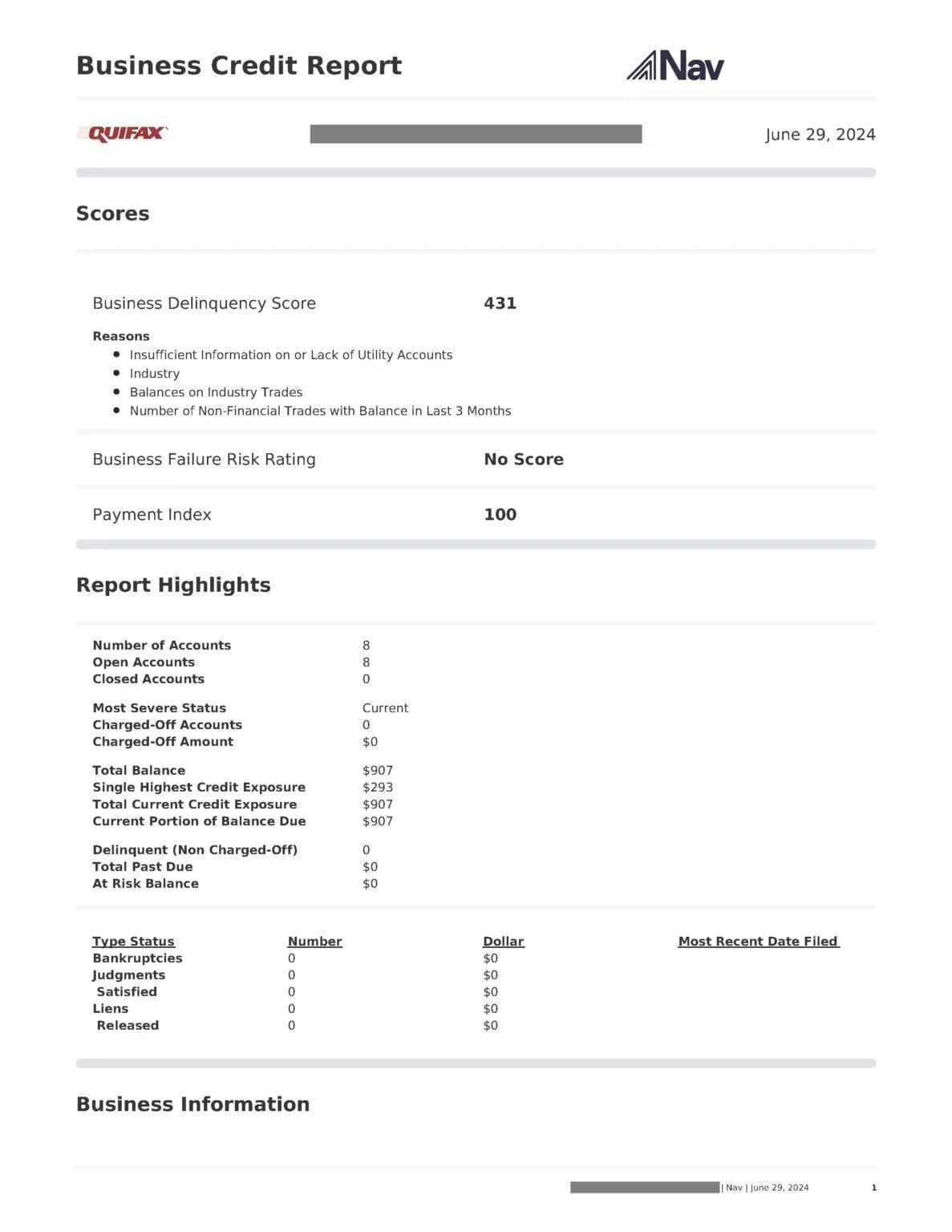

Over 33 million U.S. businesses are registered with Equifax

The credit profile created by Equifax uses information provided by vendors and the SBFE

Multiple scores based on payment experiences and firmographic information of the business

Ratings based on failure risk assessment of the business

Over 40 million U.S. small businesses are scored with FICO SBSS

The credit profile combines data from D&B®, Experian, Equifax, the business owner’s personal credit, and business financials

SBSS Score (0–300) based on payment history, outstanding debts, financial stability, and personal credit strength

Used by the SBA and lenders; minimum 140 required for SBA 7(a) loans, with 160–180+ preferred for faster approvals

W.O.C works to Prepare Your Business for Funding and Growth … in 5 Simple Steps

W.O.C helps you build business credit faster, secure maximum funding, access capital at lower rates and better terms, and even connects you with over 200 direct lenders and 3000+ funding sources—all in one easy-to-use platform.

Step 1

Know Your Bankabilty Score™ and Unlock Funding Now

With real-time insights into your business’s financial health, you’ll know exactly how bankable your business is, what funding you qualify for today, and the steps you need to take to unlock even more capital in the future. By building a strong business credit profile, you can access your Bankability Score™ and secure funding now—without being limited by your personal credit history.

Step 2

Identify Factors™ Holding You Back From Growth

Discover what’s holding you back from building your business credit profile and quickly eliminate the barriers—whether it’s your business structure, financials, or even industry risk—so you can secure the maximum amount of capital possible. With over 150 hidden factors that can block approvals, W.O.C reveals exactly what’s standing in your way and helps you fix it fast.

Step 3

Track Your Business Bureau Insights™

See what lenders and credit issuers see with real-time updates from Dun & Bradstreet, Experian, Equifax (even the secret credit reporting agencies) to ensure your business credit profile is accurate, easily fix errors, boost your scores, and improve Fundability.

Step 4

Maximize Your Bankability®

Journey through your very own Bankability roadmap with a proven software that tailors business credit building to your unique business, quickly enhancing your business credit profile to secure higher credit limits, lower rates and better terms.

Step 5

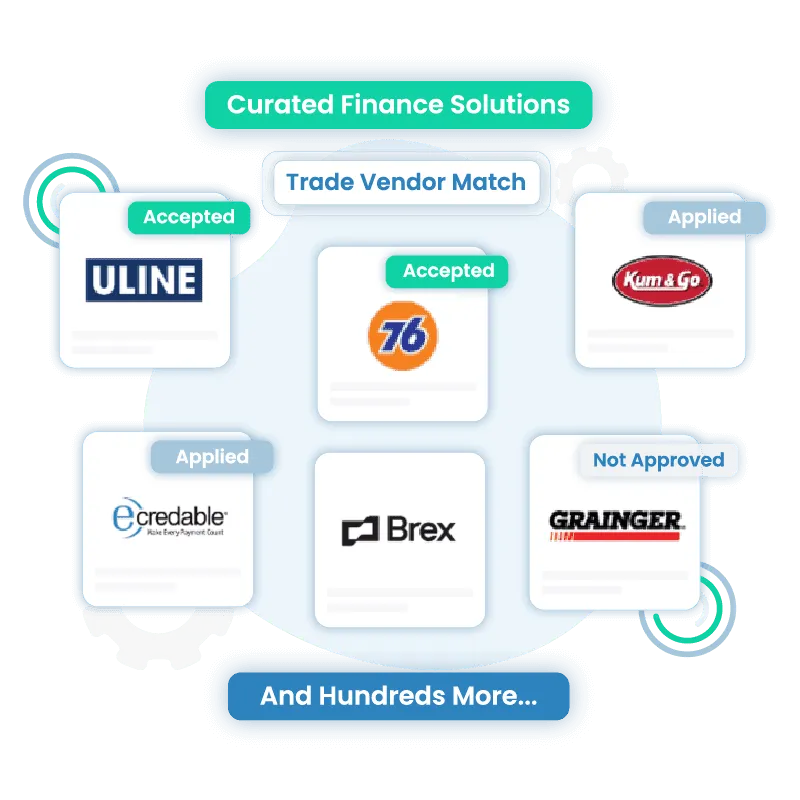

Get MATCHED With Vendors, Lenders and Credit Issuers

W.O.C matches you with both secured and unsecured credit lines, vendor accounts and even business financing based purely on the strength of your company’s creditworthiness …without relying on personal credit or personal guarantees.

With exclusive access to a database of over 3,000+ vendors, suppliers, lenders, and credit issuers, you’ll be able to build strong business credit FASTER with companies that actually report to the business credit bureaus.

The W.O.C Corporate Credit Program

Over 5,000+ Companies have gone through this program. The steps your business will go through with the service is:

Credit Foundation

Identify and fix any lender compliance

Establish your business credit profile

Follow step-by-step to build credit properly

Avoid red flags that get companies denied

Secure vendor accounts that report to bureaus

Credit Growth

Get Setup with D&B, Experian & Equifax

Access High-Limit Store Credit Cards

Access Auto Vehicle Financing

Access High-Limit Fleet Credit Cards

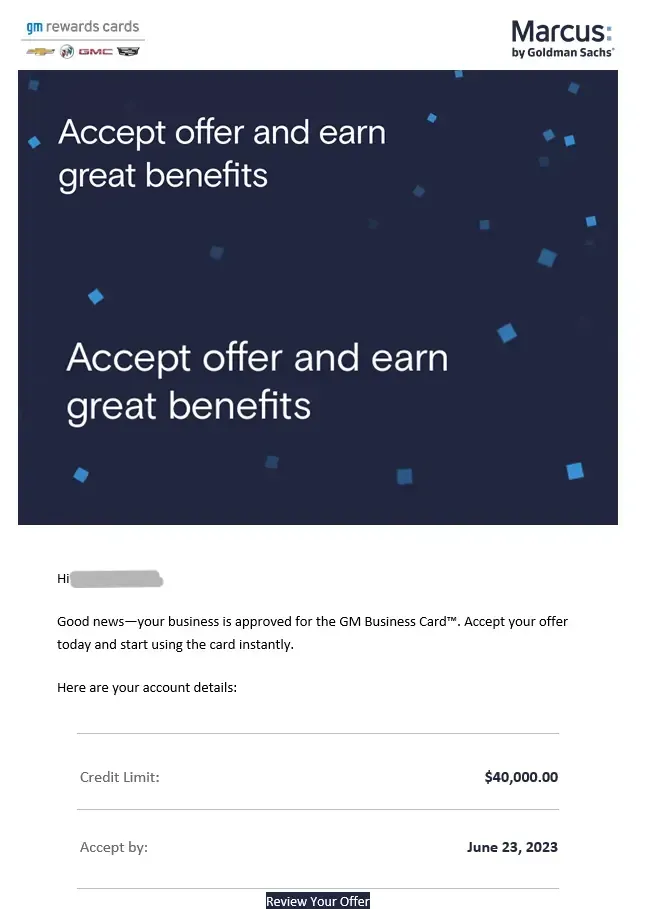

Access High-Limit Cash Credit Cards

Credit Power

Get every known no-PG business card in the USA

Establish FICO SBSS credit rating

Find the funding and credit your business needs

Unsecured, No-Doc, 0% Financing

Get Loans with Rates of 5% and Less

👉 Timeline: 90–120 days. You’ll receive weekly status updates, bi-monthly reports, direct support from your Business Credit Technician, and even personal access to our private community once your file is ready for high-level no-PG solutions.

Get the credit and financing

you've been looking for!

DOES IT STILL WORK? YES!

Can I get Business Credit cards with Bad Credit? YES!

Can I get CASH financing or loans with mid to good credit AND good Business Credit in this economy? YES!

Is there one TRUE source that spends 10 times the amount of all other companies on in-house research? YES!

Is there one place and one TRUE program that knows every possible angle and approvable options available today? YES!

Will you get Support and Help? YES!

Do you need more than a simple one bureau "score" that any business can get overnight? YES!

Will this work for my company? YES!

Do I need to be Incorporated? YES! We can do it for you for the state fees plus a very minimal charge.

About how much Credit can my Business obtain if I can't or won't Personally Guarantee anything? $75k plus cars, homes, boats, equipment and most anything a business needs.

Should I join the Program if I have good personal credit? YES! 90% of owners fail and so does their credit! PLUS you have to have good Business Credit to get any sort of SBA or Micro Finance.

Should I do this now? YES!

Business Credit Reports: Before and After

Take 5 minutes and get a REAL business credit education, not fluff!

For non-personally guaranteed credit, your business credit reports are your most valuable asset. Lenders look beyond Paydex—and it takes far more than a few on-time bills to qualify.

With 10+ years of experience, we know how to build reports that get approvals: updating outdated info, merging duplicates, and securing accounts that actually report. Fundabl helps position your business for the capital you need.

Ready to Maximize Your Funding, Get Lower Rates, and Protect Your Personal Credit?

The W.O.C Corporate Credit Program

Yes, We Can Help

Hundreds of Thousands in Business Capital and Credit is Approved EVERY WEEK...Using Fully RATED Business Credit Scores!

Separates you from your business

Limited liability of the owners and officers

Lower tax liability

100% tax deductible insurance

Reimburse 100% of medical expenses

Corporate image

Raise capital and build credit faster

Lower your audit risk as a small corporation

Protect Your Personal Assets

Stock ownership - easier to transfer assets

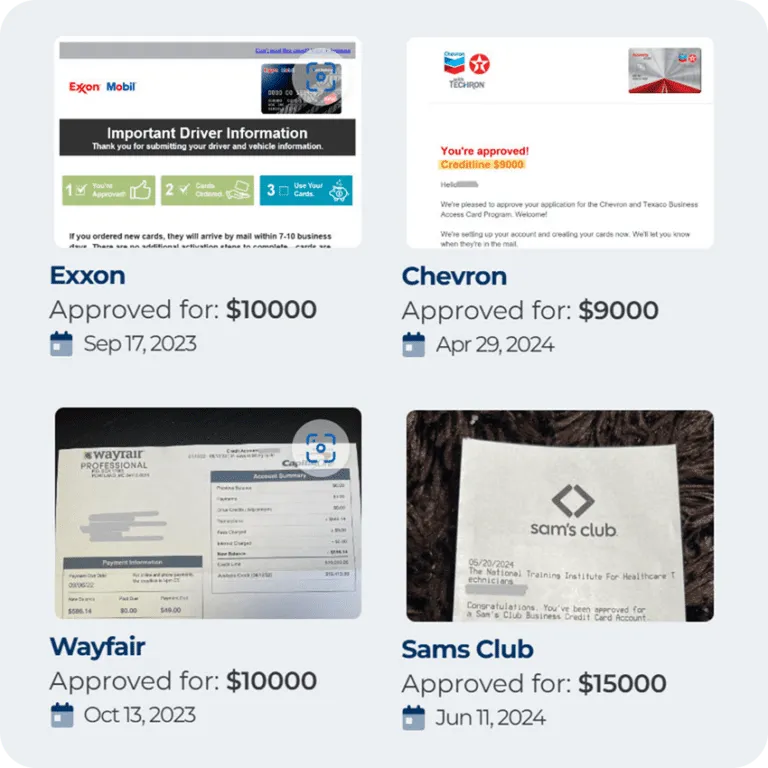

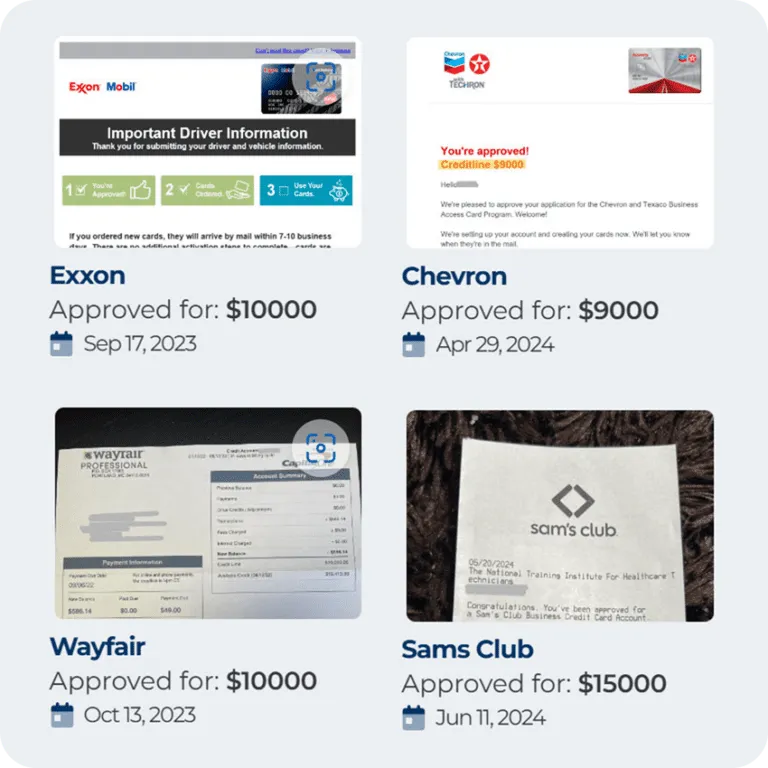

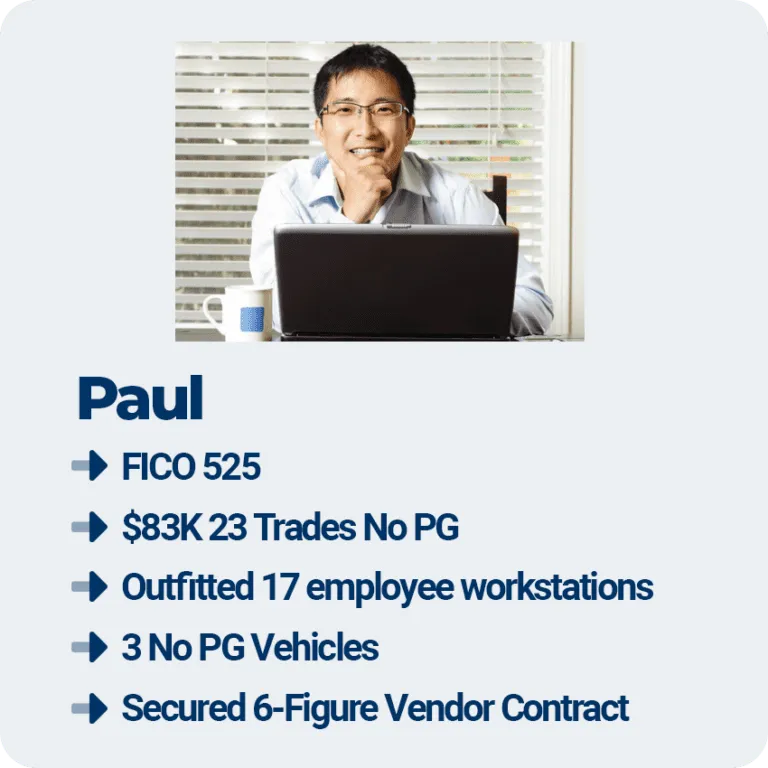

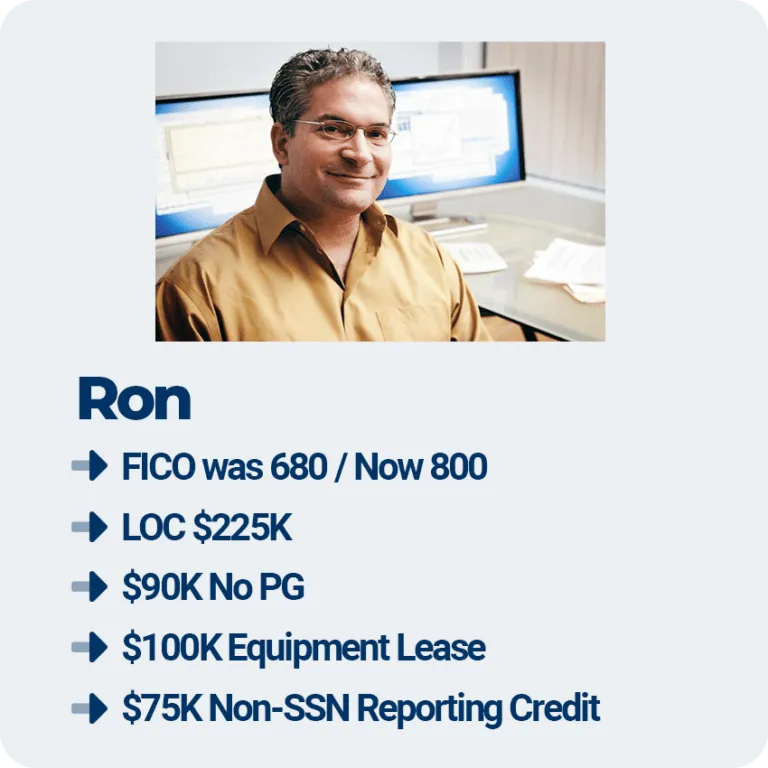

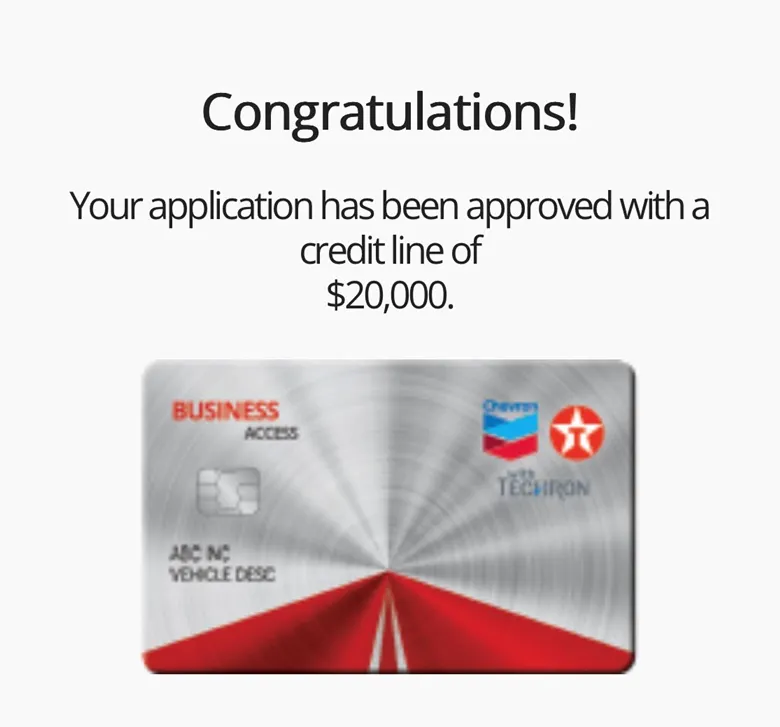

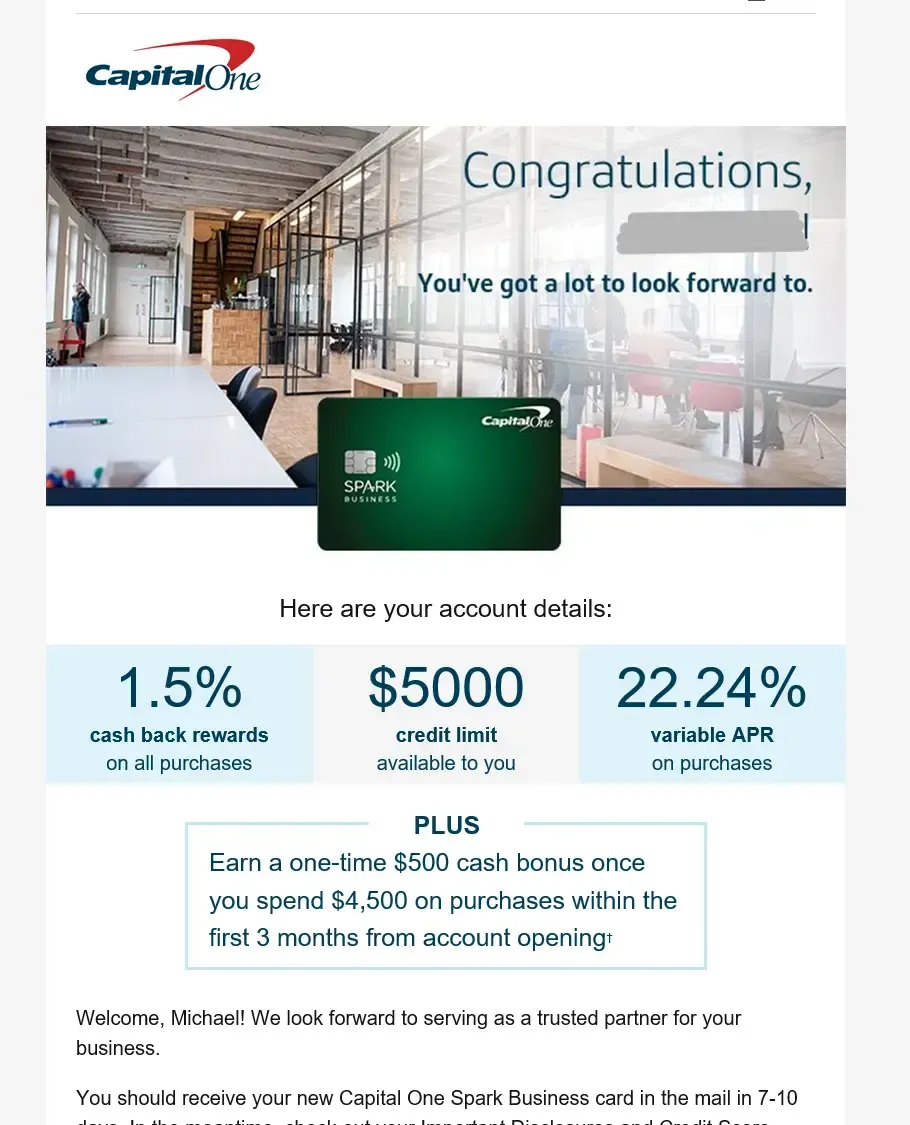

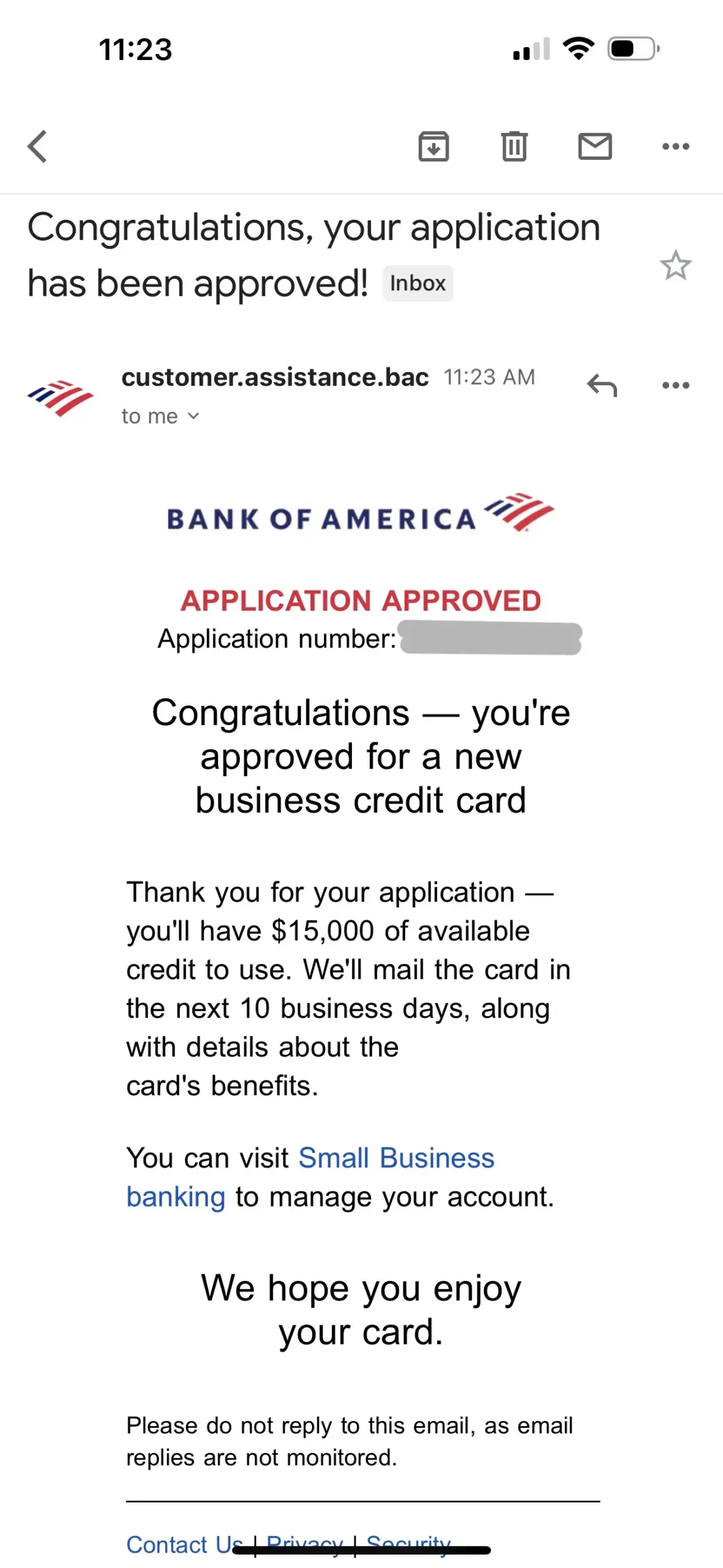

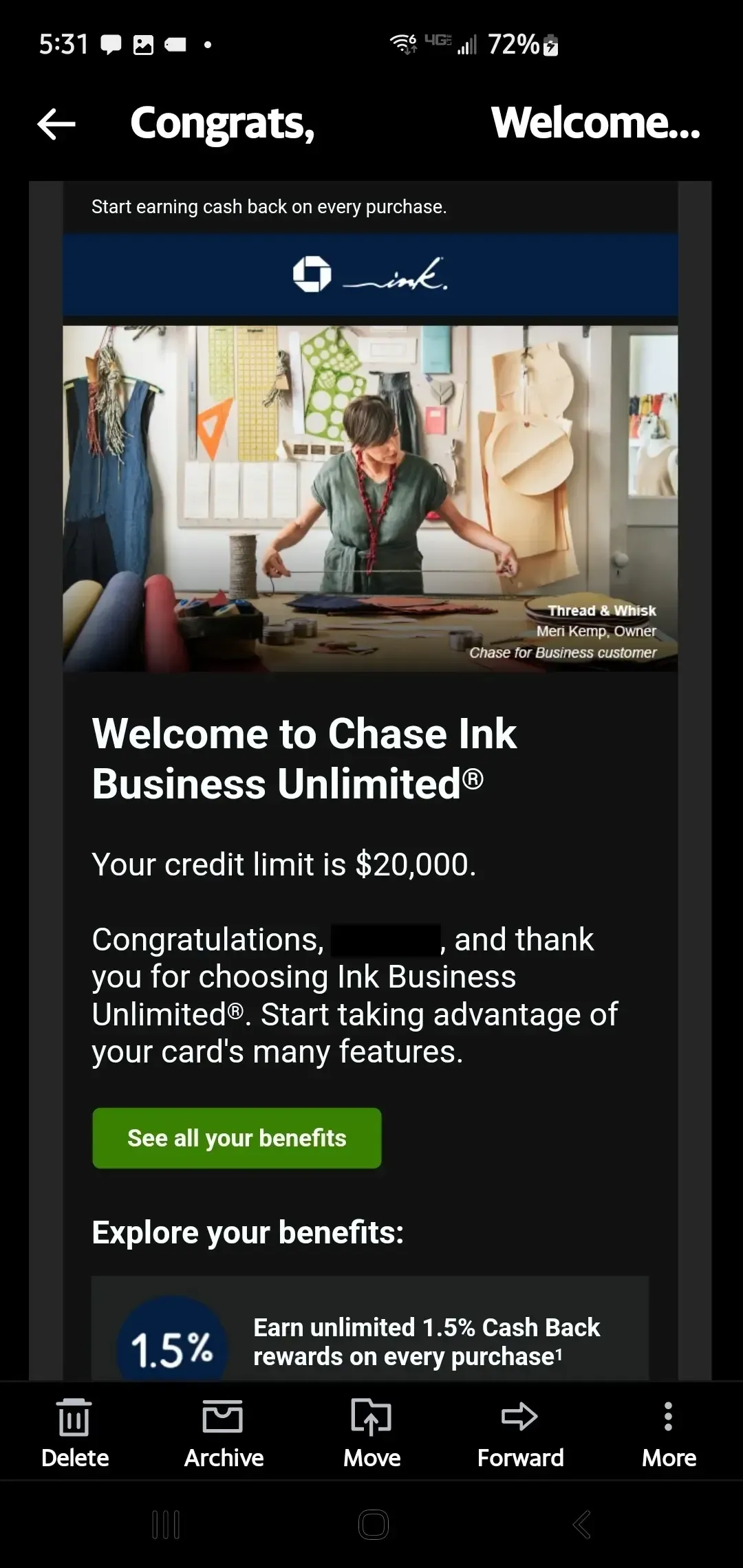

Recent Approvals

What have our clients been receiving with No Personal Guarantees?

Hear What Our Clients Have to Say

The W.O.C Blueprint has more clients and success stories than all the other services combined!

"I didn't have the first clue on how to start the process of having my New trucking business started with good credit but thanks to all of True builds help. I am off to the best start possible thanks so much "Fundabl"

"Fundbl been very informative and helpful with Pirus Group Inc. I feel very confident referring other business to Credit."

"It's great working with Corporate Credit, and always exciting to hear from my clients getting great results. A special thanks to Cassandra!!!! :)"

What are the Top Questions and Misconceptions about Business Credit?

A score with one of the business credit bureaus means I have "perfect business credit"

This is no longer true—it was a myth spread by old DIY e-books and early members back in the 2000s. Today, real business credit starts with your Experian Intelliscore, which works much like a FICO score. A few small vendor accounts paid on time may get you a basic rating, but true, powerful business credit requires multiple high-dollar trade lines across all major bureaus. These scores directly impact access to large leasing and cash credit lines. The only way to build this properly? With a real program like W.O.C.

Why Can't I do this Myself?

Sure, you might try to build business credit yourself, but after 20+ years of experience, we know most small businesses get it wrong. They pay a fee, add a few small trades, and think they’re set—only to get declined when applying at office supply stores or with major lenders. That mistake can damage your Experian file with inquiries that take months to fix.

The truth is, non–personally guaranteed credit has become much harder to secure. Nearly all major lenders, from Home Depot to Lowe’s, rely on Experian. If your file has errors, multiple profiles, or compliance issues, you’ll get declines and setbacks—not “perfect” business credit. In fact, we’ve never seen a flawless Experian file built DIY.

That’s why guessing, chasing lists, or relying on low-end programs doesn’t work. Building true business credit takes strategy, compliance, and expertise—and that’s exactly what Fundabl delivers.

I joined a service and got nowhere, is this a scam?

If you’ve joined other services, you’ve probably been chasing a “perfect” one-bureau score that never gets real approvals. At Fundabl, we take a different approach—we review all your business credit bureaus together to uncover what’s really holding you back. That’s why we’ve lasted so long: we focus on results, not buzzwords or quick-fix sales talk.

If you don’t even have basic credit cards like gas or office supply cards, chances are you’ve got Experian issues. Until those are fixed, you won’t get approvals—let alone move up to higher levels of credit.

So I read on a forum that there are no more non personally guaranteed cash credit cards?

Wrong.

What are the requirements or what would stop me from getting results?

The first rule of credit is simple: pay your bills on time. You’d be surprised how many business owners expect miracles while missing payments. If you’ve got past liens, judgments, delinquencies, or slow pays—Fundabl is your one-stop solution for fixing business credit. We charge only a minimal fee to remove issues or guide you step by step as a member. No one knows more about repairing business credit than we do. If you have an active corporation (not flagged as a shelf company), we can fix it—but remember, if you don’t pay on time, you’ll stay stuck in a cycle of bad business and personal credit.

I have good personal credit. How does this help me?

The first rule of credit is simple: pay your bills on time. You’d be surprised how many business owners expect miracles while missing payments. If you’ve got past liens, judgments, delinquencies, or slow pays—Fundabl is your one-stop solution for fixing business credit. We charge only a minimal fee to remove issues or guide you step by step as a member. No one knows more about repairing business credit than we do. If you have an active corporation (not flagged as a shelf company), we can fix it—but remember, if you don’t pay on time, you’ll stay stuck in a cycle of bad business and personal credit.

Facebook

Instagram

X

LinkedIn

Youtube

TikTok